Executive Summary:

The Hispanic population in the U.S. shows unique demographic trends and behaviors, significantly influencing household dynamics, spending habits, and media consumption, which are important for retailers to consider for targeted marketing strategies.

- The percentage of Americans identifying as Hispanic has increased to 17.0% in 2024 from 14.5% in 2020, with an average age of 42.0 compared to 51.2 for non-Hispanics. They predominantly live on the West Coast, Southwest, and Mountain states, mostly in urban areas.

- Language use at home shows 79.1% primarily speak English, up from 76.7% in 2020, and 42.7% speak only English, up from 35.6% in 2020. Among Hispanics, 38.6% were born in the U.S., with significant numbers from Mexico, Puerto Rico, and the Dominican Republic/Cuba.

- Household composition is distinct, with 47.2% having children (compared to 28.5% of non-Hispanics) and 8% expecting a baby (twice the rate of non-Hispanics).

- Hispanics spend more than non-Hispanics in all product categories except groceries and engage in leisure activities such as shopping, movies, exercising, video games, and team sports.

- They are more likely to experience major life events in the next six months (new job, moving, buying a house, getting married) despite having a lower average household income ($51,000 vs. $61,000).

- Online shopping habits show similar purchase frequency to non-Hispanics, with a preference for Target.com over Kohls.com, and slightly higher engagement with Amazon.com.

- Media consumption patterns indicate higher use of newspapers, magazines, video games, and satellite radio, but lower use of the Internet, social media, TV, and email compared to non-Hispanics.

Retailers should offer Spanish language services and targeted marketing strategies, adapting product assortments and in-store services to meet Hispanic preferences. Recognizing the significant and growing influence of the Hispanic market is crucial for retail success.

Retail Trends Among Hispanic Consumers

By Dr. Martin Block, Professor Emeritus, Northwestern University, Retail Analytics Council

According to the Prosper Insights and Analytics surveys of over 15,000 adults, the percentage of Americans identifying as Hispanic has increased to 17.0% in 2024 from 14.5% in 2020. Half of these also identify as white, while the other half identify among several other races. Hispanics are most common among Millennials and have a mean age of 42.0 compared to non-Hispanics who have a mean age of 51.2. Hispanics are more likely to live on the West Coast, southwest, and mountain states and are much more likely to live in urban areas. An important aspect of Hispanic households is the degree to which English is spoken at home. 79.1% of respondents said English was the primary language spoken, an increase from 76.7% in 2020. 42.7% of Hispanic households say they exclusively speak English at home, up from 35.6% in 2020. 38.6% of those identifying as Hispanic were born in the United States. The next highest country was Mexico at 22.9%, followed by Puerto Rico at 11.8% and the Dominican Republic/Cuba at 8.9%. Retailers should be aware that Hispanics of different nationalities exhibit differences in shopping behavior, particularly with respect to food.

Importantly for retailers, 47.2% of Hispanics have children, compared to 28.5% of non-Hispanics. Households with children spend more money shopping, a phenomenon that influences the spending patterns shown later in this article. About eight percent of Hispanics indicate they are expecting a baby, twice the level for non-Hispanics.

Also relevant to retailers is that Hispanics are more likely than the overall population to list shopping as a leisure activity (46.4% compared to 43.5%). Other common leisure activities are going to movies, exercising, playing video games and playing team sports. Note that these activities are likely to be related to the younger age of the Hispanic population.

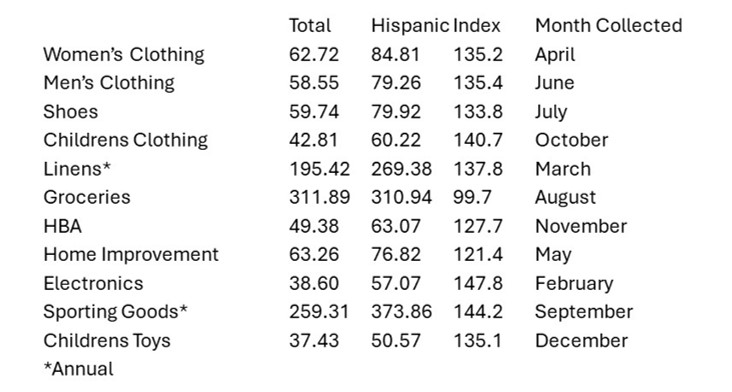

With respect to shopping, Hispanics index higher for spending amounts in all product categories except groceries, which is at the same level as the overall population. The highest relative spending amounts occur for electronics, sporting goods, clothes (men’s, women’s, and children’s), linens and toys. This is an important result for retailers as it clearly indicates Hispanics spend more than non-Hispanics across a wide array of categories. Again, there are likely age and life stage aspects related to these higher shopping frequencies.

Table 1: Hispanics by Average Monthly Spend

These are important results for retailers as they clearly indicate Hispanics spend more than non-Hispanics across a wide range of categories. Again, there are likely age and life stage aspects related to higher shopping frequency. Further analysis with decision trees evaluated the nature of the relationships between Hispanic ethnicity, age and having children. Results show that Hispanic ethnicity has a causal effect on spending levels while age and children have moderating effects on the spending levels.

Interestingly, Hispanic individuals are spending at higher levels in most categories, despite having about a 15% lower average household income ($51,000 medium income compared to $61,000 for non-Hispanic individuals). The spending patterns have clear implications for retailing, including store location, product assortment, advertising, and in-store merchandising.

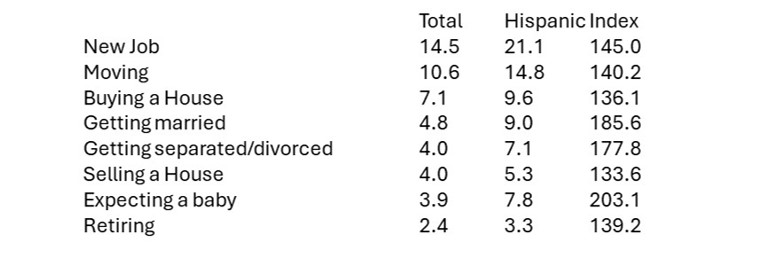

As shown in Table 2, Hispanics index considerably higher than the overall market in expected life events in the next six months, including getting a new job, moving, buying a house, and getting married.

Table 2: Hispanics by Life Events

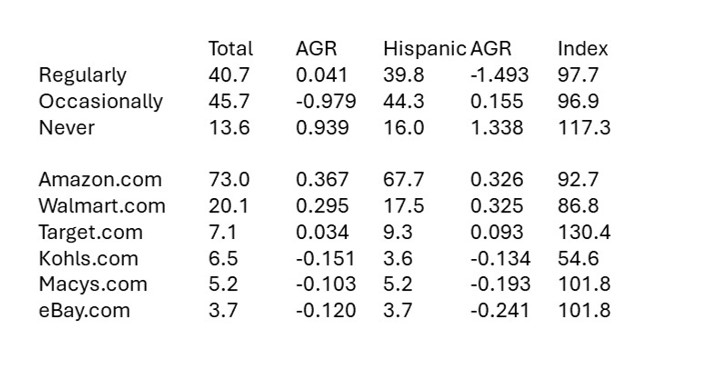

For online spending, Hispanics and non-Hispanics indicate about the same purchase frequency, with about 40% indicating they do so regularly. Hispanics are slightly less likely to shop at Amazon.com and Walmart.com, much less likely to shop at Kohls.com, and much more likely to shop at Target.com. Two-thirds of Hispanics indicate they shop at Amazon.com, slightly above the overall percentage.

Table 3: Online Spending and Retail Apps

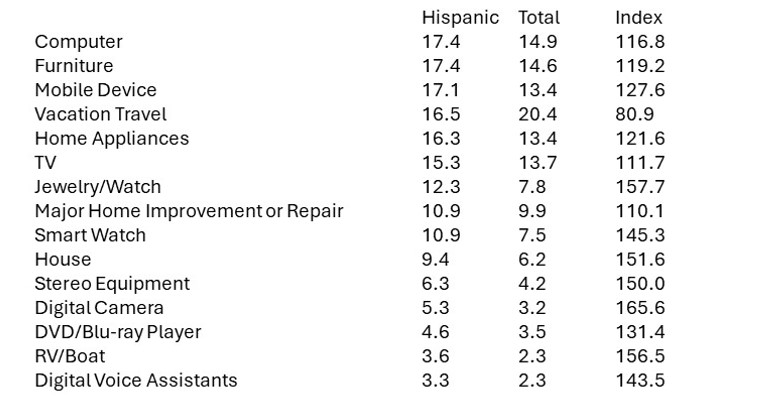

When asked about planned purchases in the next six months, Hispanics are more likely to say they will purchase computers, furniture, mobile devices, appliances and jewelry. The high frequency for several of these items likely reflects the young age and life stage of Hispanics. Retailers should realize the higher spending practices of Hispanics and adjust their marketing accordingly.

Table 4: Hispanic Big Dollar Purchase Plans in the Next Six Months

Hispanics show notable differences in media consumption as compared to non-Hispanics. Despite being, on average, younger, Hispanics index higher than the overall market for newspapers and magazines for minutes per day. They index lower on minutes per day for the Internet, social media, TV and email. They are also indexed higher for video games and satellite radio.

There are several important implications for retailers. Because Hispanics are the largest minority population in the country and their spending levels are higher in almost all categories, retailers should have targeted strategies to serve them. A key element is language, and many companies have Spanish language available in customer service (e.g., telephone answering, websites, and mobile apps). Retailers may want to consider having Spanish-speaking personnel in stores. Importantly, depending on the type of Spanish ethnicity in an area, retailers may want to offer Spanish-speaking services in the appropriate dialect.

The Hispanic population is expected to continue to grow because of immigration and the frequency of having children and will become increasingly important for retail performance.