Executive Summary:

This article presents key findings from the October 2024 Prosper Insights & Analytics survey (n=8,191), focusing on early holiday celebration plans, spending behavior, and shopping trends for the winter season. The results highlight evolving consumer preferences, spending patterns, and economic influences as the holiday season approaches.

Key Findings:

Holiday Celebrations:

- 92.8% of respondents plan to celebrate a winter holiday in 2024.

- Christmas is the most popular holiday (85.3%), followed by Chanukah (6.1%) and Kwanza (2.1%).

- There is a notable overlap: 70.3% of Chanukah celebrators and 86.3% of Kwanza celebrators also plan to celebrate Christmas.

- Despite only 58.6% identifying as Christian, Christmas celebration rates remain high, indicating its secular and cultural significance.

Spending Patterns:

- Average planned holiday spending per household is projected at $839, with gifts comprising two-thirds of this total.

- Spending on family gifts remains stable ($452), while spending on decorations, candy, and food has seen significant increases, indicating a shift towards non-gift purchases.

- Decorations and candy have experienced the highest growth, with annual increases of $2.20 and $2.33, respectively.

Shopping Timing:

- 45% of respondents plan to start shopping by October, while only 15% will wait until December.

- 62% aim to finish their shopping by the end of December.

- Reasons for delayed shopping include waiting for the best prices (45.2%) and adherence to holiday traditions (33%).

Challenges in Purchasing:

- The most anticipated difficulties in finding items are in consumer electronics (43.6%) and clothing (39.7%).

- Nearly 60% of respondents are open to purchasing gently used or refurbished gifts, with books (26.5%) and clothing (23.3%) being the most popular choices.

Online Shopping Trends:

- The rate of online shopping has grown significantly over the past 14 years, now stabilizing at around 60%.

- Economic concerns are impacting holiday spending, with 52.5% of respondents indicating adjustments in their plans, such as reduced overall spending (57.1%) and increased focus on sales (44.5%).

Holiday Travel:

- 48.8% of respondents do not plan to travel for the winter holidays.

- 22.3% intend to travel out of town, while 14.1% typically travel but will not this year, suggesting potential impacts from economic conditions or other factors.

Winter Holidays and Shopping Trends: Insights from October 2024 Data

By Dr. Martin Block, Professor Emeritus, Northwestern University, Retail Analytics Council

The winter holidays, notably Christmas, are the major retail events of the year and cover at least three months. Adults were asked about the winter holidays in the October 2024 Prosper Insights & Analytics survey (n=8,191). In response to the question, “Do you plan to celebrate any of the winter holidays this year? The percentages shown for Winter holidays in Table 1 include Christmas, Chanukah, and Kwanza. Individually, Christmas is reported at 85.3%, Chanukah at 6.1%, and Kwanza at 2.1%. Interestingly, 70.3% of those celebrating Chanukah also say they are celebrating Christmas. An 86.3% of Kwanza celebrators also celebrate Christmas.

Christmas has taken a secular turn. In January 2024, 58.6% reported identifying with a Christian religion (Catholic, Protestant, and Mormon), 3.8% said Jewish, 9.2% other non-Christian religions, and 28.5% with no religious identity. These numbers indicate a large proportion of people who celebrate Christmas but do not identify with a Christian religion.

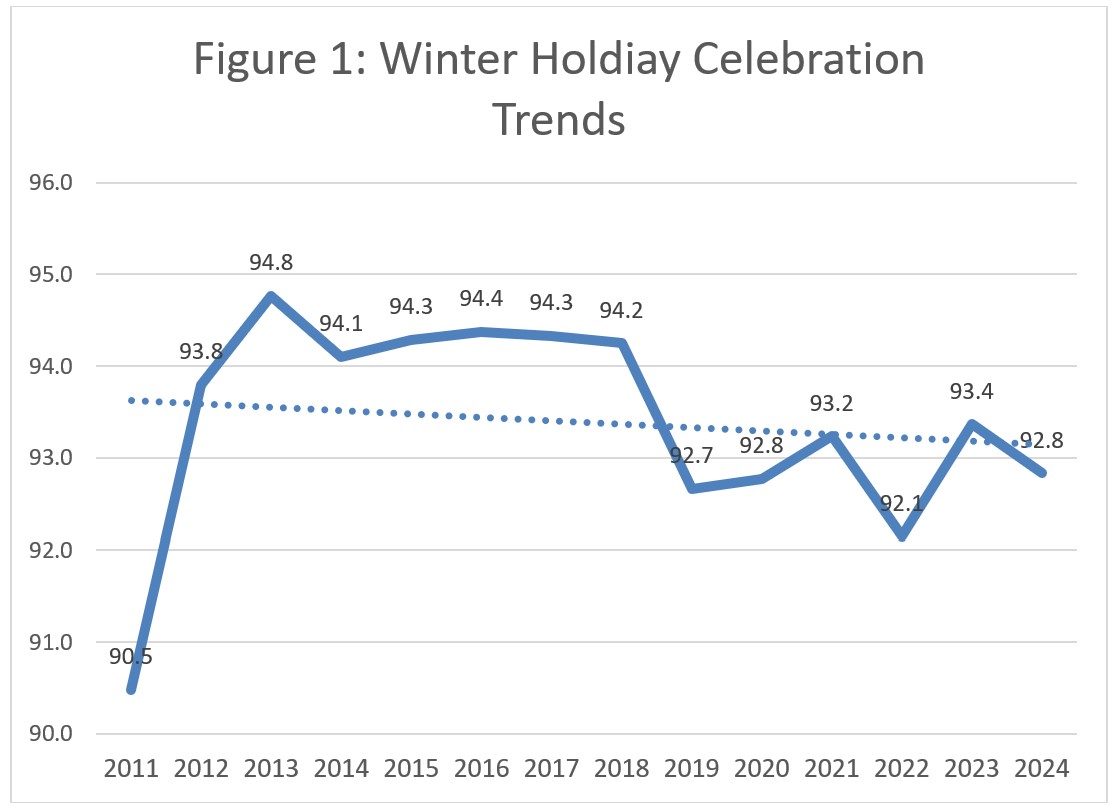

Overall, 92.8% of respondents reported planning to celebrate in October 2024. Figure 1 shows the trend for responses to this question since 2011. The 2024 results represent a very small decrease from the prior average annual decrease of .04%. The celebration percentages are almost flat over the 14 years.

Table 1: Holidays by Month

| Month | Holiday | Percent |

| January | Super Bowl | 76.9 |

| February | St. Patrick’s Day | 61.9 |

| Valentines Day | 52.0 | |

| Easter | Celebrate Easter | 80.7 |

| May | Mother’s Day | 84.2 |

| June | Father’s Day | 75.4 |

| Graduation | 33.6 | |

| July | 4th of July | 87.2 |

| Back to School | 40.1 | |

| August & September | ||

| October | Halloween | 72.4 |

| November | Thanksgiving* | 73.9 |

| December | Winter Holidays | 92.8 |

| Christmas | 85.3 |

Holiday Spending

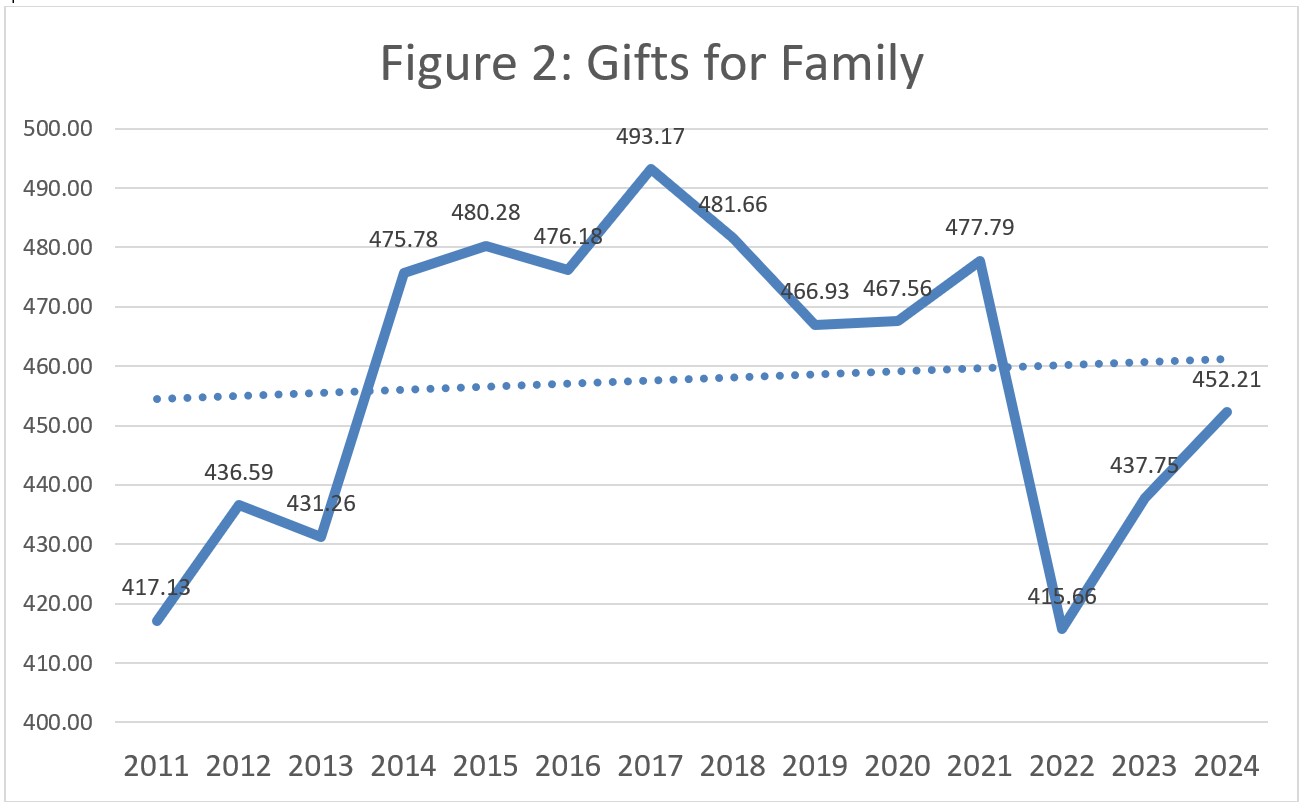

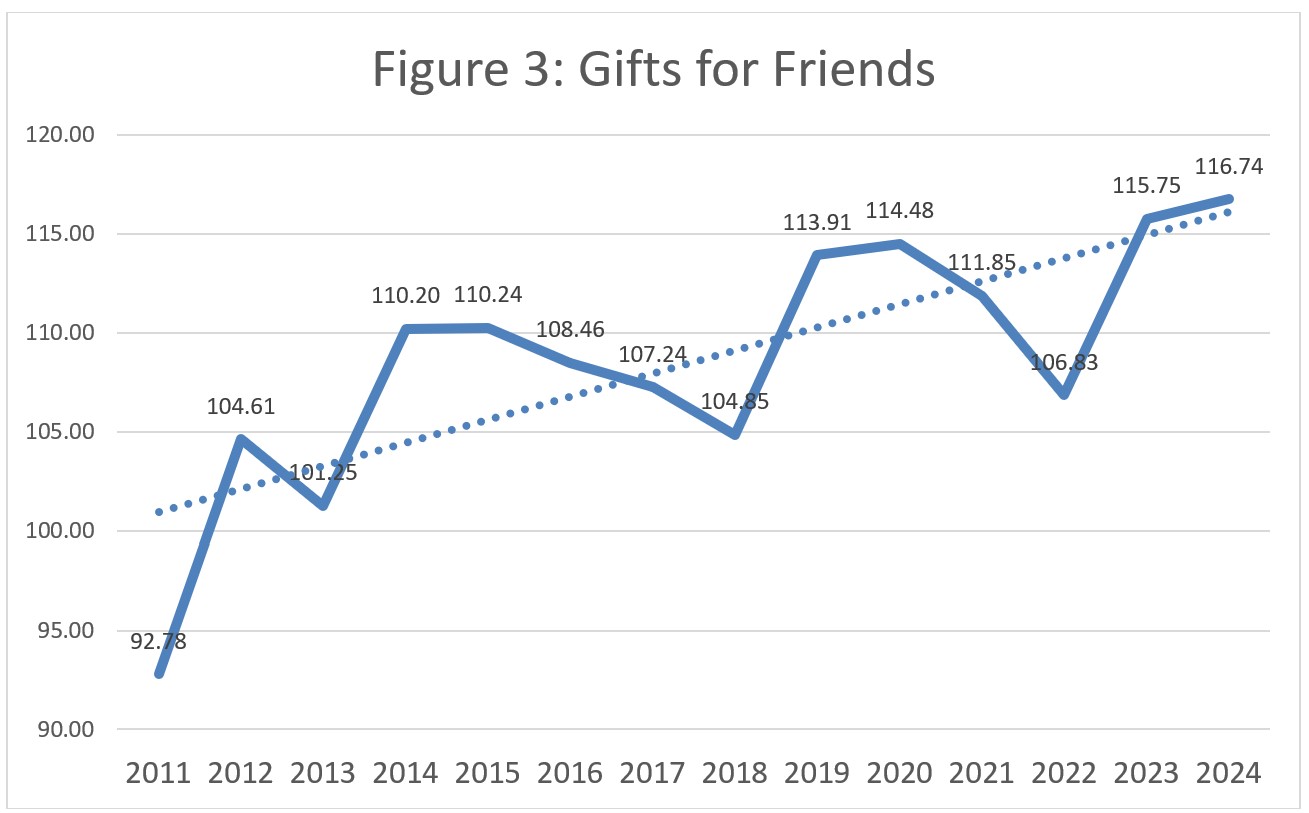

Planned spending on gifts for the family is shown in Figure 2. The planned spending is relatively flat over the 14 years, reaching a level of $452 in 2024. The pandemic year, 2022, saw a sharp drop. Spending money on family gifts still has not reached pre-pandemic highs. Spending on gifts for friends and co-workers, however, has steadily increased as shown in Figures 3 and 4.

Spending on non-gift items such as decorations (Figure 5), candy and food (Figure 6), and flowers and plants (Figure 7) all indicate considerable spending increases, with 2024 showing an all-time high. The pattern for family gifts is markedly different, perhaps indicating a cultural shift in how the holidays are celebrated.

Table 2 shows a summary of the spending by category. The overall weighted total planned spending is $839 with gifts comprising about two-thirds of the total spend. While gifts for the family have not increased at the same rate, they remain over have of the total.

Table 3 shows the relative annual growth across the categories. Over the 14 years, gifts for the family have increased only by an average annual rate of $0.52. Decorations over the same period have increased by an average rate of $2.20, and candy and food have increased by $2.33.

Table 2: Holiday Spending Comparison

| Percent Spending | Average Among

Spenders |

Percent of Total | |

| Gifts for Family | 95.4 | 452.21 | 51.4 |

| Gifts for Friends | 68.5 | 116.74 | 9.5 |

| Gifts for Co-Workers | 33.3 | 92.21 | 3.7 |

| Gifts Other | 42.1 | 84.24 | 4.2 |

| Decorations | 71.7 | 99.58 | 8.5 |

| Greeting Cards and Postage | 65.5 | 48.17 | 3.8 |

| Candy and Food | 91.6 | 141.79 | 15.5 |

| Flowers/Plants | 46.4 | 61.38 | 3.4 |

| Weighted Total | 839.01 | 100.0 |

Table 3: Holiday Spending Growth

| Percent Spending | Average | AGR | |

| Gifts for Family | 95.4 | 452.21 | 0.53 |

| Gifts for Friends | 68.5 | 116.74 | 1.17 |

| Gifts for Co-workers | 33.3 | 92.21 | 1.74 |

| Gifts Other | 42.1 | 84.24 | 1.99 |

| Decorations | 71.7 | 99.58 | 2.20 |

| Greeting Cards and Postage | 65.5 | 48.17 | 1.08 |

| Candy and Food | 91.6 | 141.79 | 2.33 |

| Flowers/Plants | 46.4 | 61.38 | 1.69 |

Shopping Plans

Early October, when the survey was conducted, is perhaps an early indication of when holiday shopping may start. As shown in Table 4, well over half of adults say they will start shopping for the holiday season in October or earlier. Only about 15% say they will start in December. As Table 5 shows, 62% say they will finish in December.

Table 4: Start Shopping for Holiday Season

| Before September | 10.2 |

| September | 8.6 |

| October | 26.2 |

| November | 40.0 |

| First 2 weeks of December | 12.5 |

| Last 2 weeks of December | 2.5 |

Table 5: When to Finish Holiday Shopping

| September or earlier | 2.7 |

| October | 7.2 |

| November | 28.2 |

| December | 61.9 |

The reasons for waiting to shop are shown in Table 6. The leading reason seems to be figuring out what is needed to buy, around 55%. It is also interesting that 45% are waiting for the best prices and promotions. One-third also say that it is a tradition.

Table 6: Reasons for Waiting

| Percent | |

| It’s when I find the best prices/promotions | 45.2 |

| It’s when I figure out what I am going to buy | 35.5 |

| It’s a tradition/when I always shop | 33.0 |

| It’s when the best holiday items are available | 25.4 |

| I don’t know what I will need to buy before November | 19.2 |

| I can’t afford to start shopping earlier | 18.4 |

The items that are most anticipated to have difficulty finding are consumer electronics and clothing, as shown in Table 7. Toys are number three.

Table 7: Anticipate Difficulty Finding

| Percent | |

| Consumer electronics or computer-related accessories | 43.6 |

| Clothing or clothing accessories | 39.7 |

| Toys | 27.7 |

| Books, CDs, DVDs, videos or video games | 27.3 |

| Home décor or home-related furnishings | 20.4 |

| Sporting goods or leisure items | 19.3 |

| Home improvement items or tools | 17.0 |

| Personal care or beauty items | 16.6 |

| Jewelry or precious metal accessories | 15.9 |

Nearly three out of five say they would consider gently used, secondhand, or refurbished items as gifts, as shown in Table 8. At the top of the list are books, followed by clothing. The reasons why gently used items are considered, as shown in Table 8, are to save money and provide greater value. About one out of five say to find one-of-a-kind items.

Table 8: Consider Gently Used, secondhand or refurbished gifts

| Percent | |

| Books, CDs, DVDs, videos, or video games | 26.5 |

| Clothing or clothing accessories | 23.3 |

| Home décor or home-related furnishings | 18.3 |

| Consumer electronics or computer-related accessories | 16.8 |

| Jewelry or precious metal accessories | 15.6 |

| Sporting goods or leisure items | 14.3 |

| Toys | 13.3 |

| Home improvement items or tools | 13.3 |

| Personal care or beauty items | 7.7 |

| None of the above | 41.8 |

Table 9: Reasons for Gently Used Items

| Percent | |

| Save money | 47.5 |

| Greater value | 24.7 |

| Be more sustainable | 22.9 |

| Find one-of-a-kind items | 20.1 |

| Afford higher-end or luxury brands | 15.7 |

| Other | 0.8 |

| None of the above | 29.0 |

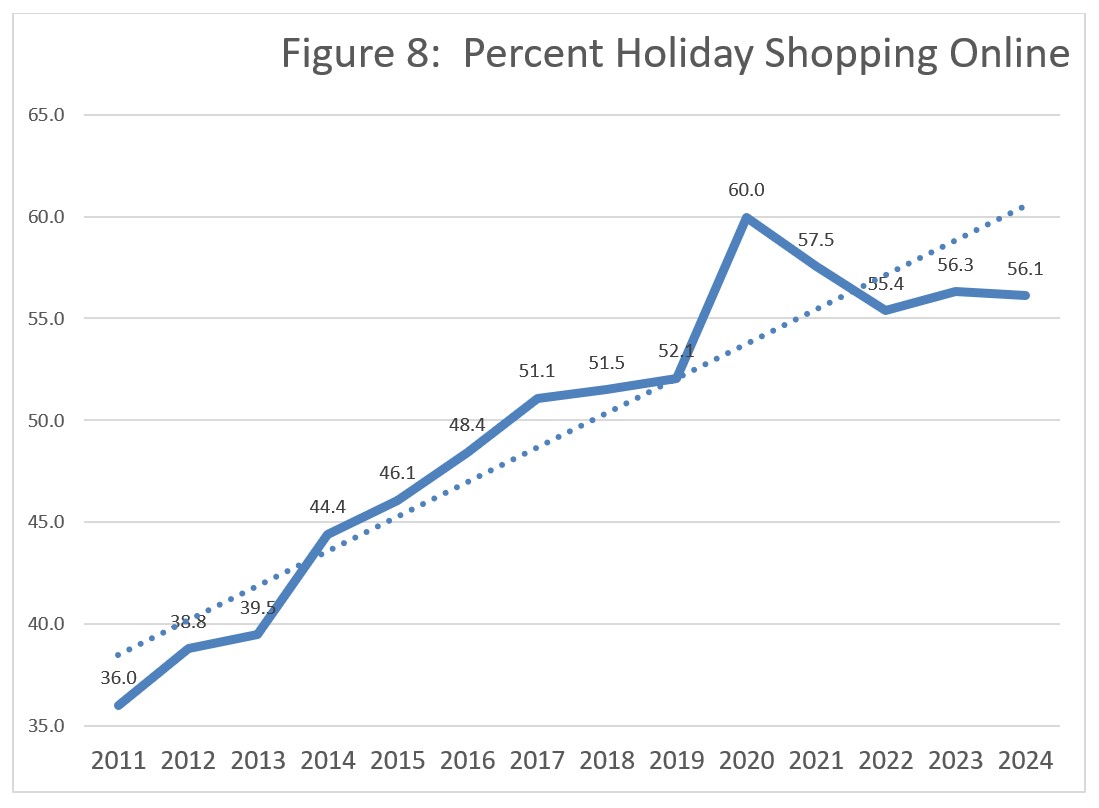

The percentage of those who say they are planning holiday shopping online has steadily increased over the 14 years, as shown in Figure 8. While the online shopping rate has hovered around 60 % for the last five years, it has grown considerably over the prior years at an average annual growth rate of 1.69%.

Just over half say the economy is affecting their holiday spending plans, as shown in Table 10. The reported impacts are spending less overall and shopping sales more often. This may relate to the family gifts discussed earlier.

Table 10: Impact of Economy

| Percent | |

| Economy Affecting Holiday Spending | 52.5 |

| Spending less overall | 57.1 |

| Shopping for sales more often | 44.5 |

| Comparative shopping online more often | 33.8 |

| Using coupons more often | 29.4 |

| Buying more practical gifts or necessities as gifts | 24.1 |

| Using last year’s decorations with no plans to buy new ones | 21.8 |

| Traveling less or not at all | 19.1 |

| Comparative shopping using my mobile phone more often | 16.9 |

| Comparative shopping with newspapers/circulars more often | 12.5 |

| Making more gifts for family and friends | 12.3 |

| Purchasing a joint gift for children, parents, or couples instead of individual gifts | 8.9 |

| Using Buy Now, Pay Later payment option | 8.3 |

| Using layaway | 7.3 |

Just over half say they are planning or considering holiday travel, as shown in Table 11. Just over one in five say they plan to travel out of town this year.

Table 11: Holiday Travel Plans

| Percent | |

| I do not typically travel for the winter holidays and won’t be traveling this year | 48.8 |

| I plan to travel out of town this year | 22.3 |

| I normally travel for the winter holidays but won’t be this year | 14.1 |

| Not sure yet | 14.8 |

This preliminary data from the October 2024 Prosper Insights & Analytics survey offers an early snapshot of consumer behavior leading into the winter holiday season. The high rate of holiday participation and the evolving spending patterns reflect broader cultural shifts, including a growing secular celebration of Christmas and an increased focus on non-gift expenditures. Economic factors appear to influence consumer choices, with a notable emphasis on budgeting, early shopping, and interest in secondhand goods. While online shopping remains strong, the varied travel plans suggest lingering caution or economic restraint.

These early findings are further analyzed with November data to capture the full scope of changing consumer behaviors and their impact on the 2024 holiday retail season.