Executive Summary:

This report explores consumer behavior and trends surrounding the Thanksgiving and Black Friday holiday shopping events based on the November 2024 Prosper Insights & Analytics survey (n=8,135).

Key insights include:

Shopping Participation:

- 3% of adults plan to shop during Thanksgiving weekend; 39.1% “definitely” and 35.2% “maybe.”

- Planning to shop has grown at an average annual rate of 0.70% over the past eight years.

Key Shopping Days:

- Black Friday is the top day for shopping (71.8%), while Thanksgiving Day (18.7%) and Cyber Monday (39.4%) show declines.

Motivations and Deterrents:

- Top reason to shop: “The deals are too good to pass up” (57.0%).

- Top reason not to shop: “I don’t enjoy the experience” (47.0%).

Digital Influence:

- Online search leads as the primary source of gift inspiration (43.6%).

- Retailer emails (25.8%) and websites (21.7%) are key tools for tracking sales.

Popular Purchase Categories:

- Clothing and accessories (54.3%), gift cards (44.3%), and toys (35.8%) rank highest.

- Thanksgiving and Black Friday remain significant shopping events, driven by deals, traditions, and increasing reliance on digital tools.

Thanksgiving and Black Friday: Trends and Traditions

By Dr. Martin Block, Professor Emeritus, Northwestern University, Retail Analytics Council

The winter holidays, especially Thanksgiving and Black Friday, are pivotal moments in the retail calendar, drawing millions of consumers to stores and online platforms in search of deals, traditions, and the festive spirit of the season. Insights from the November 2024 Prosper Insights & Analytics survey (n=8,135) reveal the growing importance of these days for holiday shopping, showcasing its continued influence despite evolving consumer behaviors and economic pressures. With nearly three-quarters of adults planning to shop over Thanksgiving weekend, these events remain a major annual highlight for both retailers and consumers.

In response to the question, “Is it likely that you will go shopping on the Thanksgiving weekend? The percentages shown for Thanksgiving are shown in Table 1, making it a major annual consumer event.

Table 1: Percentage of Consumers Shopping for Holiday-Related Events by Month

| Month | Holiday | Percent |

| January | Super Bowl | 76.9 |

| February | St. Patrick’s Day | 61.9 |

| Valentines Day | 52.0 | |

| Easter | Celebrate Easter | 80.7 |

| May | Mother’s Day | 84.2 |

| June | Father’s Day | 75.4 |

| Graduation | 33.6 | |

| July | 4th of July | 87.2 |

| Back to School | 40.1 | |

| August September | ||

| October | Halloween | 72.4 |

| November | Thanksgiving Shopping | 74.3 |

| December | Winter Holidays | 92.8 |

| Christmas | 85.3 |

About 3 out of 4 adults say they plan to shop over the Thanksgiving weekend, as shown in Figure 1. This includes 39.1% of people who say definitely and 35.2% who say maybe. Planning to shop has increased over the last 8 years despite a significant drop due to the pandemic in 2020. The average annual growth rate over the period is 0.70%.

Day of Week

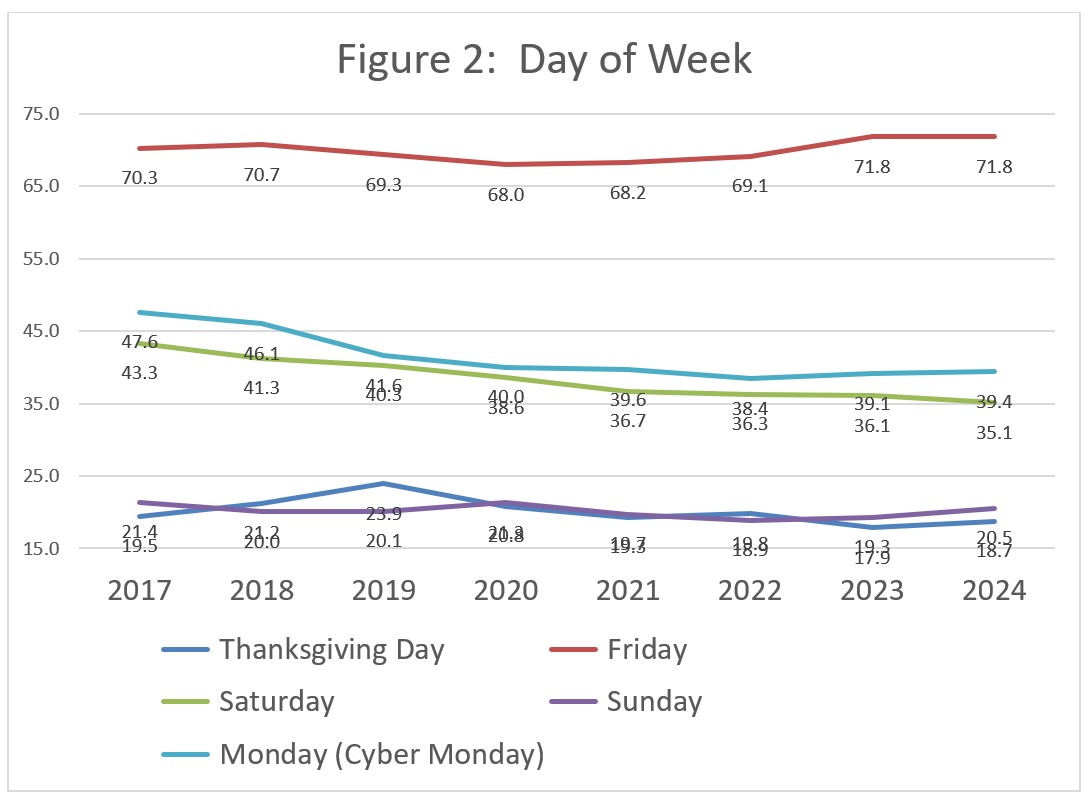

The most important day of the week for shopping over Thanksgiving is Friday, as shown in Figure 2, along with the latest 8-year trends. Table 2 shows that only Friday has increased, whereas Cyber Monday has the sharpest decline. Thanksgiving Day itself is also decreasing.

Table 2: Day of Week

| Percent | AGR | |

| Thanksgiving Day | 18.7 | -0.43 |

| Friday | 71.8 | 0.19 |

| Saturday | 35.1 | -1.16 |

| Sunday | 20.5 | -0.18 |

| Monday (Cyber Monday) | 39.4 | -1.21 |

Family tradition is what is enjoyed the most when shopping during the holiday season, followed by decorations and displays, as shown in Table 3.

Table 3: Enjoy the Most About Shopping during the Holiday Season

| Percent | |

| Family tradition | 30.7 |

| The holiday decorations and displays | 22.0 |

| Finding the perfect gift for someone | 16.6 |

| Social outing or group activity | 8.6 |

| Special holiday events or pop-up shops | 6.4 |

| The hustle and bustle | 4.1 |

| None of the above | 11.6 |

Shopping Plans

The leading reason for planning to shop over the Thanksgiving Weekend is the deals being too good to pass up as shown in Table 4. The leading reason to not shop is not enjoying the experience as shown in Table 5. A sale or discount is the leading reason to convince you to shop as shown in Table 6.

Table 4: Why Plan to Shop Thanksgiving Weekend?

| Percent | |

| The deals are too good to pass up | 57.0 |

| It’s tradition; I shop Thanksgiving weekend all/most years | 27.8 |

| I like to start my holiday shopping over Thanksgiving weekend | 23.5 |

| It’s something to do over the holiday weekend | 22.4 |

| It’s a group activity with friends/family | 14.8 |

| I like to finish my holiday shopping over Thanksgiving weekend | 14.2 |

| It’s a people-watching event | 7.9 |

| I wanted to see what the fuss is about | 4.9 |

Table 5: Why Plan Not to Shop Thanksgiving Weekend?

| Percent | |

| I don’t enjoy the experience | 47.0 |

| I never shop during Thanksgiving weekend | 44.8 |

| The deals aren’t good enough | 13.1 |

| I can get good deals all season long | 10.9 |

| I have already completed my holiday shopping | 8.4 |

Table 6: What Would Convince You to Shop Over Thanksgiving Weekend?

| Percent | |

| A sale or discount on an item I want | 27.8 |

| A free shipping offer | 11.9 |

| If a family member or friend invited me/wanted me to go | 11.6 |

| If I could know for sure the items I wanted would be available | 10.9 |

| An online or in-store event | 10.6 |

| A gift-with-purchase offer | 8.4 |

| If the best deals lasted all day long | 7.2 |

| The option to buy or reserve an item online to pick it up in-store | 6.5 |

| “Limited-time” merchandise | 6.1 |

| To support a special cause or event | 4.4 |

| Nothing would change my mind about shopping over Thanksgiving weekend | 46.9 |

Almost half (49.2%) say they started holiday shopping earlier this year. Almost 2 out of 3 (64.5%) say they have noticed higher prices items on holiday items. Overall, consumers say they have competed for 42.1% of their holiday shopping.

Table 7: Items Plan to Buy

| Percent | |

| Clothing or clothing accessories | 54.3 |

| Gift cards/gift certificates | 44.3 |

| Toys | 35.8 |

| Books, CDs, DVDs, videos or video games | 30.7 |

| Food/Candy | 29.9 |

| Personal care or beauty items | 28.0 |

| Consumer electronics or computer-related accessories | 22.6 |

| Jewelry or precious metal accessories | 20.2 |

| Home decor or home-related furnishings | 19.3 |

| Sporting goods or leisure items | 17.0 |

| Plan to give Cash | 16.7 |

| Home improvement items or tools | 13.0 |

| Flowers/Plants | 8.5 |

Consumer Contact

Online search is the leading source of inspiration for holiday gifts, as shown in Table 8. This is substantially higher than within a retail store (44% vs 30%). Retailer apps tie with television. The consumer is profoundly switching to digital methods.

Table 8: Where Will You Look For Inspiration For Your Holiday Gifts This Year

| Percent | |

| Online search | 43.6 |

| Friends/Family | 35.8 |

| Within a retail store | 30.0 |

| Wish lists | 26.2 |

| Television | 21.9 |

| Retailer apps | 21.0 |

| Advertising circulars | 17.3 |

| Email advertisements | 16.0 |

| Catalogs | 15.5 |

| 14.1 | |

| 13.4 | |

| Magazines | 10.9 |

| TikTok | 10.8 |

| Direct mail | 8.8 |

| 8.4 | |

| Online gift registries | 7.6 |

| X (Formerly Twitter) | 6.6 |

| Radio | 5.4 |

| Will not buy holiday gifts this year | 3.8 |

| Snapchat | 3.8 |

| Blogs | 2.3 |

| Other | 4.0 |

How consumers plan to keep track of promotions and sales, follows a similar pattern as looking for inspiration with emails from retailers and retailers’ websites at the top of the list, as shown in Table 9.

Table 9: How Do You Plan to Keep Track of Retailers’ Promotions and Sales

| Percent | |

| Emails from Retailers | 25.8 |

| Advertising Circulars | 24.9 |

| Retailers’ Websites | 21.7 |

| TV Advertising | 16.4 |

| 16.0 | |

| Coupon Websites (i.e. RetailMeNot.com, etc.) | 15.7 |

| Retailer Apps | 12.6 |

| 12.2 | |

| Direct Mail | 11.9 |

| Group Buying Websites (i.e. Groupon, LivingSocial, etc.) | 6.3 |

| Radio Advertising | 5.9 |

| Blogs | 4.5 |

| X (Formerly Twitter) | 4.2 |

Thanksgiving and Black Friday remain cornerstones of the holiday shopping season, drawing nearly three-quarters of consumers to participate. Black Friday continues to lead as the most significant shopping day, even as Thanksgiving Day and Cyber Monday see notable declines. The allure of deep discounts, family traditions, and the shopping atmosphere drives consumer participation despite challenges like rising prices.

As digital channels take center stage, with online searches, retailer websites, and apps leading as sources of inspiration and deal tracking, retailers must adapt to this shift. By balancing tradition with innovation, they can meet consumer expectations and create meaningful shopping experiences during these key retail events. Insights from October 2024 data on winter holiday trends provide further context on how consumers are preparing for the broader holiday season.