Executive Summary

Digital Marketing has become a mainstay in modern marketing, commanding significant budgetary allocation. Within this dynamic landscape, Retail Media Networks (RMNs) and Influencer Marketing Platforms (IMPs/ Creator Marketing Platforms) have emerged as two of the fastest-growing components of digital marketing. However, despite their potential, brands are facing significant friction in effectively leveraging these channels, a challenge rooted in a fragmented ecosystem, a lack of differentiation, overlapping audience segments, disparate measurement systems, walled gardens, and unique individual touchpoints.

This research paper proposes a strategic roadmap for brands to effectively utilize RMNs and IMPs as part of an integrated approach to digital practices. By embracing a consumer-first perspective, brands can achieve cohesive, integrated efforts that drive incremental growth for all stakeholders. The paper examines the current ecosystem, identifies key stakeholders, and recommends strategic directions. It provides insights into the current challenges and opportunities, leading to the proposal of a novel solution that highlights the power of strategic integration.

Ultimately, the paper outlines six key recommendations for all stakeholders looking to maximize digital marketing.

- Prioritize a consumer-first strategy

- Brands should have yearly/ quarterly Joint Business Plans (JBPs) that include the brand marketing, shopper marketing, RMNs, IMPs, Agency partners, and other 3rd party stakeholders (Pinterest, Trade Desk, etc., moving beyond campaign focus to business needs.

- Align KPIs with Return on Marketing Objective

- Integration between RMNs and IMPs is essential to unlock strategic value for brands. It must also move beyond simple boosting.

- An omnichannel approach should extend seamlessly to include in-store touchpoints.

- Measurement must be transparent, clear, and consistent across channels to provide a holistic view of performance.

Retail Media Networks and Creator Marketing in the Digital Marketing Ecosystem

By Melanie Chen, Vivian Meng, Krithikha Radhakrishnan, and Shuyi (Aurora) Wang

Introduction

Over the past two decades, the rise of digital technology has fundamentally reshaped consumer behavior and the digital marketing landscape. This transformation has moved the marketplace from a product-centric model to a dynamic, consumer-driven approach. This shift, accelerated by the COVID-19 pandemic, has transformed consumers from passive recipients to active participants and co-creators.

Today’s consumer is digitally savvy, highly informed, and constantly connected. Consumers demand and expect personalized, seamless experiences. With access to unprecedented volumes of information, rising trust in electronic word-of-mouth, and the emergence of communities, digital marketing must go beyond simple conversion. Brands must actively engage consumers at every stage of their journey, from research and evaluation to consideration, and strive to craft a consistent, omnichannel experience that reaches them at the right place and right time.

Digital consumption is deeply embedded in daily life, with adults spending an average of 6.5 hours per day online.1 Mobile usage is particularly high, with 44% of consumers spending over five hours daily on their smartphones.2 Consumer behavior is characterized by a desire for convenience and instant gratification, resulting in a demand for seamless, omnichannel experiences.3 As “digital nomads,” they can effortlessly move between channels and expect personalized, innovative, and contextually relevant experiences.4 This trend is also reflected in shopping habits, where consumers desire an “always-on” experience that allows them to start a purchase on one channel and complete it on another.3

Digital marketing is constantly evolving and commands significant budgets with global spending exceeding $700 billion in 2024, representing 72.7% of global advertising and an annual growth of 17%.5 These findings are further substantiated by survey results conducted for this project. The survey revealed that 91% of brands increased their budgets in 2025, with 31% increasing spending by more than 10%.6 The primary components are SEO /SEM, social media, programmatic ads, connected TV, DSPs, retail media, and influencer marketing.

Retail Media Networks (RMNs) and Influencer Marketing Platforms (IMPs or Creator Platforms) are one of the newest and fastest-growing areas. RMNs, the advertising platform run by retailers, is historically used to drive lower funnel marketing, reaching $153B in 2024,7representing 18% of digital marketing budgets. Creator marketing drives upper-funnel awareness and consideration, and accounts for another 10-15%8 of the marketing spend.

Despite this growth, the promise of a seamless consumer experience remains elusive. Digital marketing practices are fraught with problems, including fragmentation,9 limited differentiation, overlapping audiences, disparate measurement systems, and the ‘walled gardens’ of major platforms. These issues create unique, individual touchpoints that prevent a holistic view of the consumer, making a truly cohesive and seamless journey for the consumer a major challenge brands have to overcome.

This report serves as a practical, step-by-step guide on how brands can strategically partner with and leverage RMNs and Creator Marketing Platforms to build cohesive campaigns and drive incremental profits and long-term brand and consumer value.

Market Overview

Digital marketing, a data-driven marketing approach, offers significant advantages over traditional methods. It facilitates two-way communication, fostering a deeper connection12 between consumers and brands through direct interaction and feedback. Crucially, its measurable results allow businesses to track campaign performance in real-time, enabling them to make data-driven decisions. It is complex and has several stakeholders.

Retail Media Networks

Defined as advertising channels owned by retailers, Retail Media Networks (RMNs) emerged from the industry trend of companies collecting and leveraging their consumers’ first-party13shopper data. The term RMN has evolved to Commerce Media Network(CMNs)14 to include companies beyond traditional storefronts to any business with access to valuable first-party data, such as delivery apps, consumer packaged goods (CPG) brands, fashion, ride-sharing, and finance.

This core value of this ecosystem is its ability to use first-party shopper data, such as purchase history, browsing habits, and loyalty program, to help identify intent-based consumers and create a closed-loop system that directly links ad exposures to sales outcomes across both onsite and offsite programmatic/ CTV placements using a data clean room. This has helped make RMNs like Walmart Connect and Instacart Ads a necessary investment to compete in the marketplace.

RMNs is the fastest growing digital network, and US spending is projected to climb from $60 billion15 in 2024 to $72B10 in 2025, with an annual growth rate of 21.8%. Though there are more than 200 players, it is dominated by a few key players. Amazon is the market leader with a massive user base of 300M active users, closed-loop attribution, and a full range of ad formats spanning search, display, in-store media, and CTV (Prime Video). Walmart Connect, the second-largest player, differentiates itself with its impressive retail footprint (4,700 stores) and offers an omnichannel approach that connects digital ads to its physical stores. Target Roundel sets itself apart through its loyalty program, Target Circle. Specialized players like CVS Media Exchange carve out a niche by leveraging access to health-conscious shopper data and front- and back-of-store audience data. Cross-retailer platforms like Instacart Ads offer access to high-intent shoppers from CPG and alcohol brands.

Rise of Creator Commerce

Creator marketing, also known as influencer marketing, leverages individuals who produce curated digital content to foster community and drive authentic brand engagement12. Creator marketing includes content across videos, blogs, and social media and can be monetized through sponsorships, direct sales, and subscriptions. It is rapidly growing, with the global influencer marketing industry projected to reach $32.55 billion in 2025, a 35.6%8 year-over-year growth. In the U.S., its adoption has moved from an experimental to a core strategy, with 86%8 of marketers now incorporating influencer campaigns. This trend is substantiated by our quantitative research, which indicates a significant increase in brand investment in Creator Marketing (CM). Over three-quarters of surveyed brands (78%) reported a growth in their CM budgets this year, a notable rise from the 36% who reported a similar increase in 2024. This change can be attributed to the fact that 21-22%6 of U.S consumers report purchasing products based on influencer recommendations. This impact is particularly strong among Gen Z and lower-income shoppers, highlighting the channel’s ability to drive bottom-funnel results.

Research Methodology

Two separate data collection processes were performed for this study. The first was a qualitative study comprising over 20 in-depth interviews with key personnel in the digital marketing practice. The second was a quantitative survey of managers in digital marketing positions. The two components are described below:

We conducted 22 in-depth qualitative interviews with key stakeholders across experts in brand marketing, RMNs, creator marketing, and the broader digital marketing ecosystem. The objective of a qualitative study is to:

- Understand current industry situations and challenges

- Identify the success metrics used to evaluate campaign performance

- Collect existing integration best practice

- Explore stakeholder perspectives on AI and future opportunities

Each interview lasted 30-60 minutes, guided by a structured, open-ended interview guide tailored to participants’ expertise.

Participants in the qualitative study were mainly from 4 stakeholder groups:

- RMNs: six top networks across the industries in Traditional Retailer, Travel, and Social Commerce

- Brands: six major players in CPG, Food & Beverage, and Travel

- Creator Marketing: Three leading creator marketing platforms

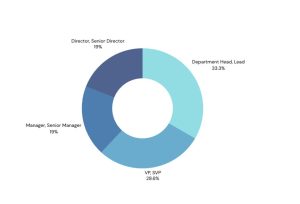

- Agencies & Industry Experts: seven professionals from marketing service agencies, technology providers, and consulting firms. The figure below depicts the job titles of the participants.

Survey Research

An online survey targeting digital marketing professionals to understand their perceptions and practices in digital marketing, with a particular focus on creator marketing and RMNs. This survey is partnered with LTK as part of an annual tracking study, with refinements and additions.

This survey includes 50 questions, including:

- Brand Background: six questions

- Digital Marketing Practices: eleven questions

- Creator Marketing: seventeen questions

- RMN: six questions

- AI usage and attitudes: three questions

Topics covered include measurement metrics, engagement methods, and budget allocation strategies.

The analysis centered on cross-industry comparisons to identify meaningful differences and highlight areas of opportunity. Additionally, responses were weighted to align with the industry distribution from the prior year’s study, ensuring consistency in year-over-year tracking. This supports us to focus on uncovering digital marketing trends over time and provides forward-looking insights to guide future integrated strategy.

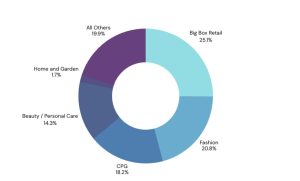

The survey had 204 completions from marketing professionals across 14 industries. The detailed industry distribution is shown below:

*All others include: Health and Wellness / Fitness, Services, Technology / Electronics, Airlines, Automotive, Food Service, Grocery, Travel / Entertainment, Other.

Key Findings

The research findings are presented for a series of topics that span the concerns of the participants in the two studies.

The five areas of concern are Organizational Problems, Relationships between Key Entities, Authenticity, Metrics, and Consumer Issues.

Organizational Problems

The challenge for organizations is predominant across the brands, retailers, and creators

Siloed Organizations – The Shifting Dynamic between Brand and Shopper Marketing

Historically, brand manufacturers have been divided into two distinct, and often siloed, teams: brand marketing and shopper/trade marketing, according to their roles, functions, and budgets.

- Brand marketing teams focus on the broad branding objectives and consumer-facing communication. Their goal is to position the brand, build awareness, shape brand sentiment, and create a positive brand recall and identity through digital channels of connected television, email, mobile SEO, SEM, etc.

- Shopper marketing teams, conversely, manage relationships with individual retailers. They focus on securing valuable shelf space, promotions, and localized communication to drive and meet in-store sales goals.

As Lisa from Adastra noted, “Coca-Cola’s brand team does TV ads and tracks favorability. The shopper team owns retailer relationships like Target. So the brand marketing team they were with the brand’s media agency, and they own that brand budget. And then there’s a shopper marketing team that owns the relationship with each retailer. And like these two teams, like shopper marketing and brand, like never the two shall meet. They never meet.” As Katie from Hyaat noted, “Brand Marketing shouldn’t always look like sales, very different from Retail, we want our page to be more about the experience than sales, only 20% sales.”

However, when RMNs first emerged, brands assigned them to existing shopper marketing teams, as they already handled the retailer relationship. However, these teams often lack the necessary cross-functional expertise to handle consumer-facing practices, including the skills to optimize performance metrics and analyze campaign data effectively. For example, as one executive noted, “Media teams don’t have capabilities for long-term retailer planning, and trade teams don’t know advertising. It’s a fundamental conflict.”

Moreover, while retailers generally run their promotions independently, RMN campaigns live in the digital ecosystem and can be seen by anyone, resulting in consumers receiving fragmented, disjointed, and uncoordinated messaging from the brand.

This fundamental disconnect poses a significant challenge to a cohesive brand strategy aligned to the consumer journey. The teams responsible for long-term business planning with retailers are separate from those with advertising expertise, making it difficult to create a unified approach that leverages both brand-building and sales-driven initiatives. With RMNs vying for brand marketing budgets, this further complicates the already siloed organizational structure.

Fragmentation – The RMNs Explosion

The proliferation of over 200 RMNs has introduced another layer of complexity. Brands must manage a large number of retail media partners in order to reach consumers. This is compounded by the fact that the increase in marketing budget is not commensurate with the increase in the number of channels, increasing the fragmentation of spend. For example, CPG brands work with 10-15 RMNs, and they will increase to 20 by next year. As Peter from ‘The CPG Guys’ noted, “70 cents of every dollar goes to Amazon, and 14 cents to Walmart,…” The remaining platforms are left to fight over a small fraction of the market, showcasing a decline in ROI across the board. These give rise to three significant problems:

- Rising operational complexity: Managing campaigns across a highly fragmented landscape with individual retailers running parallel campaigns

- Prioritization Ambiguity: Brands struggle to decide where to allocate their limited budget for the best return, leading to inefficiencies.

- Audience Targeting Ineffectiveness: The fragmented nature of the platforms makes it difficult to achieve consistent and effective audience targeting, especially as audiences shop across several retailers. This is corroborated by the decreasing ROI, which suggests RMNs may be shifting existing sales rather than driving new ones, or that consumers are just flocking towards the retailers that offer the biggest discounts.

Fragmentations in Creator Collaborations

Brands have a variety of options when working with creators, including direct partnerships, RMN affiliate programs, and using IMPs. Most brands employ multiple methods, often driven by different internal teams. For example, as Julia from United Airlines highlighted, “We have a few influencers we work with who we have on retainer. For more project-based work, we use Creator IQ, using their tools to search for influencers that we might want to work with.” As Megan from Mizkan mentioned, “So we use both RMN and the direct way. We work with Acorn, but we tap into only their network of influences. However, we have a very in-depth social influential program where we kind of look at them as together.”

The spread of responsibility across multiple departments leads to two substantial problems.

Lack of Unified Strategy: With different teams handling creator collaborations independently, the brand’s messaging becomes inconsistent. A lack of central oversight means efforts are often not coordinated, leading to inefficient resource allocation and a disjointed consumer experience.

Creative vs. Commercial Tension: As one executive noted, “We don’t want brand campaigns to look like sales campaigns.” This creates tension, especially when the brand-building team prioritizes authenticity and creative integrity while a sales-driven team focuses on the commercial goals.

The rise of retail media networks has created an imbalance in the power dynamic. Brands often feel coerced into investing in RMN to secure a favourable placement in-store and maintain their store presence. As a senior executive from Ferrara mentioned, “Sometimes the retailers expect you to do it, so you do it. And I don’t know to what extent we do it for that versus what’s the actual payback there?” Katie from Simple Mills compared it to a “table stakes” requirement if they consider the retail partner a priority partner.

This is further complicated by the proliferation of private labels, which get preferential placement in stores. As Peter from ‘The CPG Guys’ voiced, “It’s like a store owner being told by the mafia to pay protection money for their street. When I ask, ‘Who are you protecting me from?’ they say, ‘From me.’ I shouldn’t have to pay advertising money to fix a problem you artificially created.” This has led to a breakdown in trust, as brand teams feel like their RMN spending is not a true partnership with an equitable ROI, but a “money grab” by the retailer.

There is a perception gap between what brands expect from an investment in RMNs and the internal operational reality of retailers. Brands invest in RMNs with the belief that it will strengthen their relationship with the retailer and drive coordinated sales with merchandising and the communication team working hand in glove. However, RMN teams often operate independently, separate from the merchandising and purchasing teams. Similarly, the Affiliate Creator teams in-house also operate independently and do not align with the overall RMN campaign. As one RMN source noted, “My merchant partners and I are not in the same negotiations together. We work separately.” This internal fragmentation is mirrored in how different teams handle campaigns, as articulated by Nicole from Albertsons, “I lead the creator aspect of campaigns, collaborating with the media and merchandising teams to ensure strategies are aligned at a high level. For execution, these teams tend to operate independently, driving their own tactical plans toward a unified set of KPIs and success metrics.” This disjointed approach is visible in external relationships between platforms. Ally from LTK, “We work with a wide range of retail media networks – sometimes as separate clients, sometimes in tandem. In large organizations, it’s common for different departments to engage with creators through their own priorities and KPIs. Retail Media is no different. While this can create complexity, it also highlights the opportunity for more aligned, omnichannel strategies that move beyond transactional relationships toward true strategic partnerships.” However, according to brand managers, this lack of alignment sometimes makes the brand’s investment feel purely transactional rather than a strategic partnership, and, at a macro level, the ecosystem lacks a unified, omnichannel strategy.

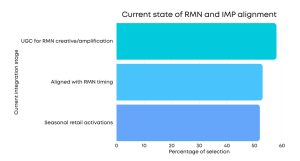

The current alignment between RMNs and IMPs is fragmented and inconsistent. Currently, 58% of brands integrate the two channels by having creators produce user-generated content (UGC), which is amplified on RMN channels. While 50% of creator campaigns align with RMN timing, the integration remains seasonal and campaign-specific rather than part of a cohesive, long-term marketing plan.

This highlights two critical challenges in the current ecosystem. The first is an inconsistent leveraging of the creators on the RMN platform. This is mainly due to creator content being used in silos rather than integrated into the full funnel. The second is the lack of data visibility in cross-platform collaboration. This means neither brands nor IMPs can leverage broader behavioral data within RMNs to optimize creator campaigns. The survey explored the connectivity of RMNs with IMPs, with the results depicted as follows:

What is a UGC?

A unique challenge for IMPs is navigating the fine line between brand control and creative authenticity. As Rodney from LTK notes, “The clients just want everything to be easy, and they want prescriptive briefs and to push a button for push. But an influencer is human, and authentic and creator content needs to be adapted to platforms.” Brands often desire prescriptive briefs and a “push-button approach”. But unlike images and video content, creator-generated content cannot simply be copied and pasted across different channels. Each platform requires adaptation and customization, a process that helps the content appeal to the community and the needs of the platform. This helps the content build engagement and momentum, or as one source referred to it as the “snowball effect.”

Secondly, creators build their brands and foster a loyal community based on their authenticity. For this reason, they must be able to authentically integrate a brand’s message into their content to drive maximum engagement and reach. To address this, brands should focus on the following:

- Choose the right influencers – Brands should partner with creators whose ethos aligns with their own, thereby authentically leveraging the creators’ community

- Provide flexible briefs – Instead of prescriptive scripts, brands should offer flexible briefs where they highlight a few key Unique Selling Propositions (USPs) that the creators should prioritize

- Focus on Brand-Building – The strength of Creator Marketing lies in its ability to build long-term brand-building and the “snowball effect” of organic engagement and long-term customer lifetime value as opposed to immediate conversions.

Metrics Confusion

For RMNs, there is a lack of transparency about how metrics are calculated. As a senior executive from Ferrara mentioned, “I don’t necessarily trust their numbers….they don’t give you a lot of information about how that’s calculated.” Therefore, there is an opportunity to build computation transparency, giving brands not just the final performance numbers but visibility into how it is calculated and where the creatives are placed. By opening the “black box” of attribution models, placement logic, and data definitions, RMNs can strengthen the trust with their brand partners. As Megan from Mizkan mentioned, this could be done by providing “a transparent measurement process or allow 3rd party solutions to be plugged in for performance.”

Secondly, there is a fundamental misalignment of metrics. RMNs often prioritize Return on Ad Spend (ROAs); brands view this as a “storytelling metric” that doesn’t take into account the sales that would have occurred regardless of ads. This is an opportunity for RMNs to provide measurements and metrics that are directly tied to the business and marketing objectives. Along with Impressions, CTR, and ROAs, RMNs should also provide incrementality, Customer Acquisition Cost (CAC), Customer Lifetime Value (CLTV), New-to-business consumption, Point of Market entry, etc. As Peter from ‘The CPG Guys’ mentioned, “They (Brands) need to know that they can measure performance the way they want to measure performance…. ” RMNs can position themselves as trusted partners. Anni Fan from Pinterest elaborates on this point, “…Retail Media provides brand-level ROAS to brands…Some started exploring incrementality, which I feel is still at an early stage in the space. You want to build a measurement system of truth and find the right measurement metrics that align with your marketing objective. If your campaign has an awareness objective, SKU-level ROAS may not be the best metric to measure success.”

Finally, there is a strong opportunity to bring consistency and standardization in metrics across problems. Currently, KPIs are defined differently across networks, with measurement parameters hidden, and even the depth of performance data differing from platform to platform. This makes it difficult for brands to compare KPIs across platforms. As Gonzalo from BCG mentioned, “Not every RMN gives you the same metrics… not every KPI equates to the same thing. For example, Amazon measures impressions and views differently, based more on when the ad was shown than on whether it was viewed or how long it was viewed. Limitations on reporting accessibility further complicate this. Amazon allows you access to only one month of historical data, vs. the 2–3-year ranges for Meta and Google, making it tricky to conduct year-over-year growth (YoY) and long-term trends across categories.” Anni from Pinterest seconds this and mentions consistency is essential. “…a lack of standardization. Pinterest is investing in our product innovation and solutioning to drive greater consistency in this space, including brand attribution and Pinterest Media Network Connect. It is a bit challenging to look at performance across all RMNs. Most RMNs have their own methodology, and it may not always be apples to apples across the board, which makes it hard to compare across from a brand perspective.”

Aligning on standardized definitions of metrics, attribution models, and data ranges would improve the brand’s decision-making and confidence in investments. Furthermore, this will help accelerate the growth and create benchmarks for success.

Rebuilding Consumer Trust

The modern consumer journey is nonlinear and complex. As Matt from Expedia points out, “Travelers visit on average 141 different websites 45 days leading up to booking travel.” Moreover, as Josh from Dentsu pointed out, “If you’re serving the same ad to a person who is at the top of the funnel versus the person who is ready to purchase, you’re not going to be effective.” This creates an opportunity for RMNs and Brands to move beyond fragmented, ineffective advertising to personalized communication. The current ecosystem is plagued by a lack of seamless, omnichannel messaging, as retailers run their programs independently. The consumer is therefore exposed to inconsistent brand messages, leading to information overload and digital fatigue.

Furthermore, some of the precise targeting by RMNs can make it feel “creepy” and “transactional” to the consumer, raising privacy concerns.

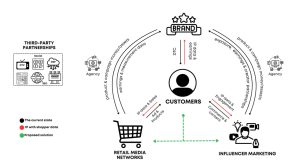

Brands and RMNs have an opportunity to build a cohesive, personalized experience that respects consumer privacy and delivers contextually relevant messages at every stage of their journey. By prioritizing a joint business plan with an integrated, value-driven approach, brands can foster trust, reduce frustration, and create a more meaningful connection. Ideally, this would be represented by a framework such as the following:

The integration of RMNs and creators into all of digital strategy represents a powerful pathway for success. Traditionally, these two channels have operated at opposite ends of the marketing funnel: creator marketing has focused on upper-funnel objectives such as brand awareness and discovery, while RMNs have dominated the lower-funnel with their focus on driving direct sales.

Integrating them into a single, holistic marketing ecosystem transcends simple channel connections; it unifies audiences, data, and operational efficiency, thereby creating a smoother consumer journey, delivering more value for each stakeholder than they could generate in isolation. This would result in a more seamless and holistic journey for consumers, guiding them from initial discovery and consideration to a purchase and long-term brand loyalty, driving both short-term revenue growth and long-term brand-building and customer lifetime value.

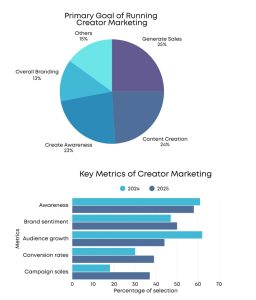

Survey results confirm this shift. Creators are moving further down the funnel towards purchase transactions. This is evidenced by the shift in their primary campaign goals: today, nearly 25% of creators’ primary campaign goals are sales generation, with content creation and awareness following closely at 24% and 23% respectively. This is further substantiated by key metrics, with the importance of conversion rates and sales increasing significantly from 2024 to 2025. This trend confirms that IMPs are no longer just for engagement; they are considered key drivers of commerce, as indicated by the results in the figures below:

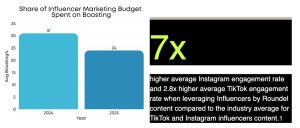

Furthermore, creators command a greater influence over brand budgets. As noted by Rodney at LTK, creators are tapping into not only influencer and brand-building budgets, but also a percentage of the RMN co-op dollars. The source shared, “Typically, brands have co-op dollars that they need to spend through Target’s Roundel network. And… as part of that, they want to spend those on Influencer.” This means creators are gaining influence over how brands allocate a portion of their RMN budgets. If RMNs fail to provide visibility and integrate with creator platforms, they will not only miss an opportunity to access larger budgets but also risk their future growth potential.

Currently, most RMNs and IMPs’ collaboration is limited to boosting creator content into sponsored placements across retailers’ owned-and-operated media. While this approach provides a short-term sales lift, it has several limitations. Boosting is merely a form of ad placement; it repackages authentic and community-driven content into paid, transactional advertising, undermining its credibility. Moreover, as boosting often occurs months after a creator campaign launches, it reinforces RMNs’ lower-funnel role rather than unlocking full-funnel integration as indicated below:

True integration goes beyond repurposing content for paid placement. It deploys creator content seamlessly across RMN channels – onsite, offsite, and in-store, linking it directly to commerce. This approach maintains authenticity, strategically leverages RMN’s first-party data, and creates a continuous path from inspiration to purchase. While boosting drives a short-term sales increase, a true, holistic integration will build lasting consumer trust and generate measurable, long-term growth.

The integration of RMNs and creators with digital strategy provides several strategic advantages for brands:

- Enhanced Consumer Segmentation: By combining the first-party shopper data from RMNs with the demographic and psychographic data from creators, brands can build more robust and accurate consumer segments. This richer data set allows for precise targeting and personalization across all channels.

- Holistic Campaign Execution: This enables brands to create holistic, full-funnel campaigns that reach consumers at contextually relevant moments throughout their entire purchasing journey. This approach replaces fragmented, channel-based budget allocation with a value-based strategy that focuses on the consumer experience.

- Incremental Growth and Long-Term Value: The seamless transition from awareness to purchase helps brands achieve incremental growth. By balancing short-term sales objectives with long-term brand building, this strategy enhances visibility and relevance, while also allowing brands to anticipate consumer needs, inform product development, and ultimately increase customer lifetime value.

Conclusions

The big promise for Retail Media Networks and Creator Marketing in the overall digital strategy lies in their integration: RMNs provide first-party shopper data, while creators bring community and authenticity. By integrating these two industries, brands can move beyond lower-funnel tactics and unlock larger budgets, ensuring future growth. This fusion allows creators to move beyond upper-funnel awareness, driving conversions and proving clear ROI. Ultimately, this partnership enables brands to achieve incremental growth and deliver a truly holistic customer experience, guiding consumers seamlessly from inspiration to purchase.

To guide this transformation and maximize your digital marketing efforts, we present six key recommendations for all stakeholders:

- Implement a Consumer-First Strategy: Shift digital advertising from a funnel-led to an audience-centric approach to overcome consumer challenges like digital fatigue and fragmented experiences.

- Establish a Joint Business Plan (JBP) – Brands must build annual or quarterly JBPs with all key stakeholders – from the brand marketing, shopper marketing, RMNs, IMPs, Agency partners, and 3rd party stakeholders (Pinterest, Trade Desk). This moves the focus beyond campaigns to core business needs, bridging organizational gaps and leveraging cross-functional expertise.

- Align KPIs with ROMO – Aligning Key Performance Indicators directly with your Return on Marketing Objective ensures a complete view of success, balancing brand-building with performance and prioritizing true value exchange across stakeholders.

- Integrate Beyond Simple Boosting – Integration between RMNs and IMPs is essential to unlock strategic value for brands. Move beyond boosting creator content, which is a short-term fix that turns authenticity into paid ads. True integration is essential for providing a continuous path from inspiration to purchase and unlocking strategic value.

- Create a Seamless In-Store and Omnichannel Experience – A truly holistic consumer journey requires a seamless omnichannel approach that includes in-store touchpoints. This leverages the unique strengths of Retail Media and inspires consumers both online and in person.

- Ensure Transparent Measurement – Make cross-channel measurement non-negotiable by ensuring it is transparent, clear, and consistent across all channels. This is crucial for providing a holistic view of performance and building trust within the digital ecosystem.

Appendix

1.DataReportal. (2025). Digital 2025 Global Overview Report. DataReportal.

2. DemandSage. (2025). Smartphone Usage Statistics 2025 (Worldwide Data By Age). DemandSage

3. Riaz, H., Baig, U., Meidute-Kavaliauskiene, I., & Ahmed, H. (2022). Factors Effecting Omnichannel Customer Experience: Evidence from Fashion Retail. Information, 13(1), 12.

4. Furquim, T. S. G., da Veiga, C. P., da Veiga, C. R. P., & Silva, W. V. (2023). The Consumer Experience in Omnichannel: A Systematic Literature Review. In D. M. Leal, T. T. C. V. Leal, A. V. S. de Souza, & W. V. Silva (Eds.), Marketing and Smart Technologies (pp. 287–298). Springer.

5. IAB Internet Advertising Revenue Report: Full Year 2024. IAB and PwC.

6. Retail Analytics Council & LTK. (2025). Retail Media and Creator Marketing Budget Survey 2025.

7. eMarketer. (2025). Worldwide Retail Media Ad Spending 2024. Insider Intelligence.

8. Influencer Marketing Hub. (2025). Influencer Marketing Benchmark Report 2025. Influencer Marketing Hub.

9. Criteo. (2025). 101 Guide to Walled Gardens in Advertising & Spend Diversification. Criteo.

Pathlabs. (2024). Thriving in a Fragmented Market: Leveraging Advertising Diversity. Pathlabs.

10. Juaneda-Ayensa, E., Moscoso-Sánchez, D., & Muro-Rodríguez, A. I. (2020). Consumer Experience and Omnichannel Behavior in Various Sales Atmospheres. Frontiers in Psychology, 11.

11. Furquim, T. S. G., da Veiga, C. P., da Veiga, C. R. P., & Silva, W. V. (2023). The Consumer Experience in Omnichannel: A Systematic Literature Review. In D. M. Leal, T. T. C. V. Leal, A. V. S. de Souza, & W. V. Silva (Eds.), Marketing and Smart Technologies (pp. 287–298). Springer.

12. Chaffey, D., & Ellis-Chadwick, F. (2022). Digital Marketing: Strategy, Implementation and Practice (8th ed.). Pearson.

13. Piwik PRO. (2024). What is first-party data and how does it benefit your marketing. Piwik PRO.

14. Fluent, Inc. (2025). Commerce Media vs. Retail Media: Everything You Need to Know. Fluent, Inc.

15. eMarketer. (2025). US Retail Media Ad Spending Forecast, 2024–2028. Insider Intelligence.

16. Shopify. (2025). What is Social Commerce? Trends and Key Insights for 2025. Shopify.

17. Amra & Elma. (2025). TOP SOCIAL COMMERCE STATISTICS 2025. Amra & Elma.

18. Brand24. (2025). 11 Key Influencer Marketing Metrics You Should Track in 2025. Brand24.

19. Superfiliate. (2025). Types of Creator Partnerships for Influencer Programs. Superfiliate.

20. Hightouch. (2024). What Is a Data Clean Room? The Complete Guide. Hightouch.

Piwik PRO. (2024). What is first-party data, and how does it benefit your marketing? Piwik PRO.

21. Meyer, D. (2022). The Flywheel Model vs. The Funnel. HubSpot.

dentsu. (2024, October). Ad Spend Growth Tracks Ahead of the Economy. https://www.dentsu.com/news-releases/ad-spend-growth-tracks-ahead-of-the-economy

GRIN. (n.d.). 10 Proven Strategies to Influence Consumer Purchase Decisions with Creators. https://grin.co/blog/10-proven-strategies-to-influence-consumer-purchase-decisions-with-creators/

Sprout Social. (2024). The State of Social Media in 2024.

IAB. (2024). State of Data Report 2024.

Solomon Partners. (2024, May). The Rise of Retail Media. https://solomonpartners.com/wp-content/uploads/2024/05/Solomon-Partners-%E2%80%93-The-Rise-of-Retail-Media-May-2024.pdf

Inmar. (2024). 2024 Retail Media Network Success. https://www.inmar.com/trends/2024-retail-media-network-success

Influencer Marketing Hub. (2025). Influencer Marketing Benchmark Report 2025. https://influencermarketinghub.com/influencer-marketing-benchmark-report/

Juniper Research. (2024). Digital Ad Spend to Reach $753B. https://www.juniperresearch.com/press/digital-ad-spend-reach-753-bn/

dentsu. (2024, October). Ad Spend Growth Tracks Ahead of the Economy. https://www.dentsu.com/news-releases/ad-spend-growth-tracks-ahead-of-the-economy

Keends. (n.d.). Marketing Mix Modeling vs. Multi-Touch Attribution. Retrieved August 29, 2025

https://keends.com/blog/marketing-mix-modeling-vs-multi-touch-attribution/#:~:text=improve%20conversion%20rates.-,How%20does%20MTA%20work%3F,Limitations%20of%20MTA

LiveRamp. (n.d.). Data Clean Rooms. Retrieved August 29, 2025

https://liveramp.com/data-clean-rooms/#:~:text=A%20data%20clean%20room%20is%20a%20secure%20and%20impartial%20area,and%20use%20the%20data%20effectively.

Didomi. (n.d.). Data clean rooms: Frequently asked questions. Retrieved August 29, 2025

https://www.didomi.io/blog/data-clean-rooms#:~:text=get%20quite%20complicated.-,Data%20clean%20rooms%3A%20Frequently%20asked%20questions,without%20exposing%20personally%20identifiable%20information

Funnel.io. (n.d.). MTA vs. MMM. Retrieved August 29, 2025

https://funnel.io/blog/mta-vs-mmm#:~:text=Marketing%20mix%20modeling%20(MMM)%20and,effectiveness%20of%20specific%20marketing%20channels.

Meet the Researchers

This research was supervised by Frank Dudley and Frank Mulhern of the Retail Analytics Council and conducted by:

Melanie Chen

Spiegel Scholar

2025

Vivian Meng

Spiegel Scholar

2025

Krithikha Radhakrishnan

Spiegel Scholar

2025

Shuyi (Aurora) Wang

Spiegel Scholar

2025